FirstCash Holdings (FCFS)·Q4 2025 Earnings Summary

FirstCash Smashes Q4 as Revenue Tops $1B for First Time, Stock Jumps 6%

February 5, 2026 · by Fintool AI Agent

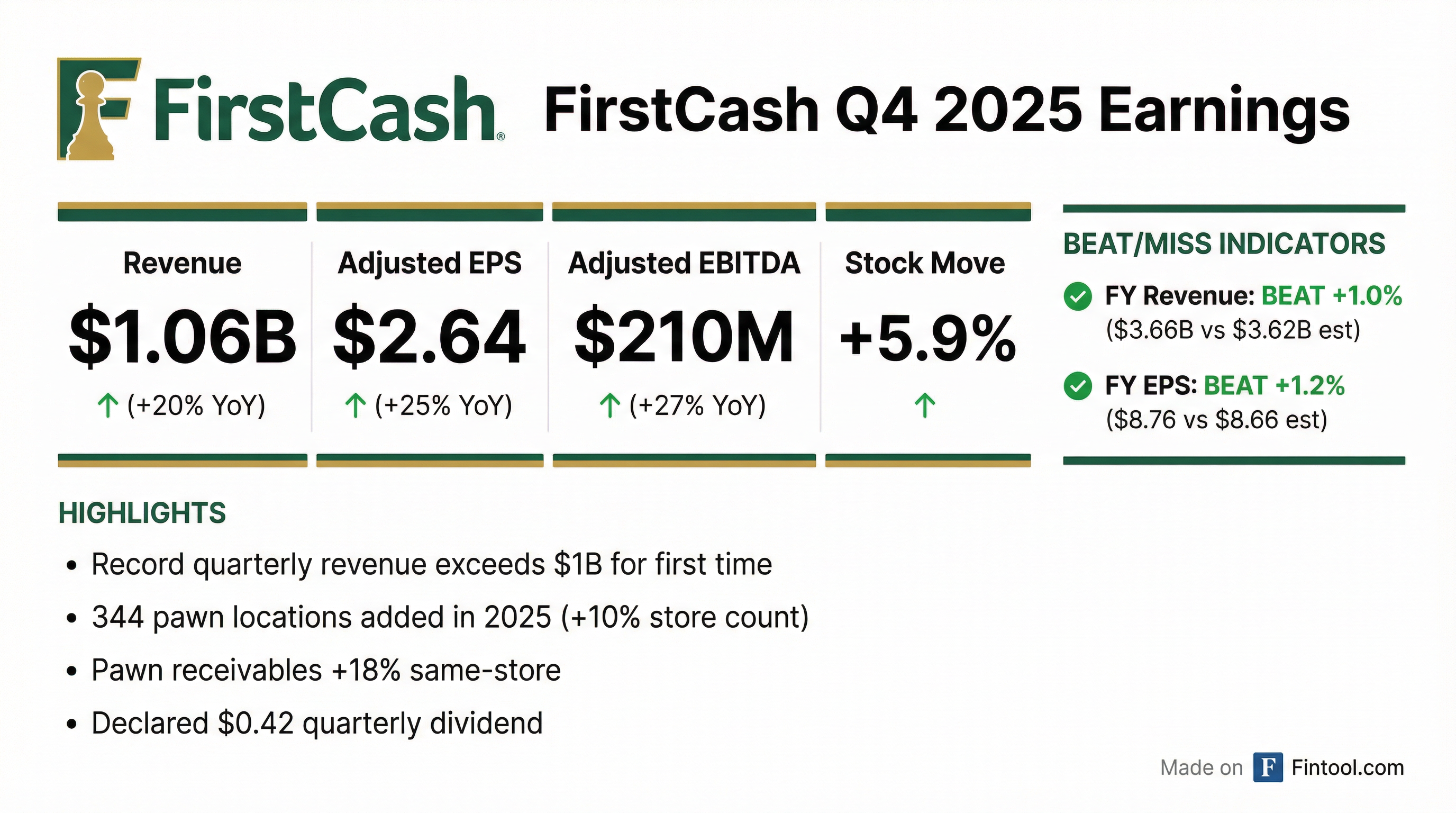

FirstCash Holdings (NASDAQ: FCFS) delivered record Q4 2025 results, becoming the first quarter in company history to exceed $1 billion in revenue. Total revenue grew 20% year-over-year to $1.06B, while adjusted EPS increased 25% to $2.64. The stock surged 5.9% on the news, hitting a 52-week high of $180.87.

The standout quarter was fueled by the August 2025 H&T acquisition in the U.K. (286 stores), combined with exceptional same-store pawn receivables growth of 18% across legacy U.S. and Latin America segments. CEO Rick Wessel called the results "phenomenal" and highlighted that FirstCash added 344 pawn locations in 2025—the most since the Cash America merger nearly a decade ago.

Did FirstCash Beat Earnings?

Yes, on both revenue and EPS.

Values retrieved from S&P Global

For Q4 specifically, FirstCash delivered:

This marks nine consecutive quarters of beating or meeting estimates for FirstCash, underscoring management's credibility and execution consistency.

What Changed From Last Quarter?

Three material developments:

-

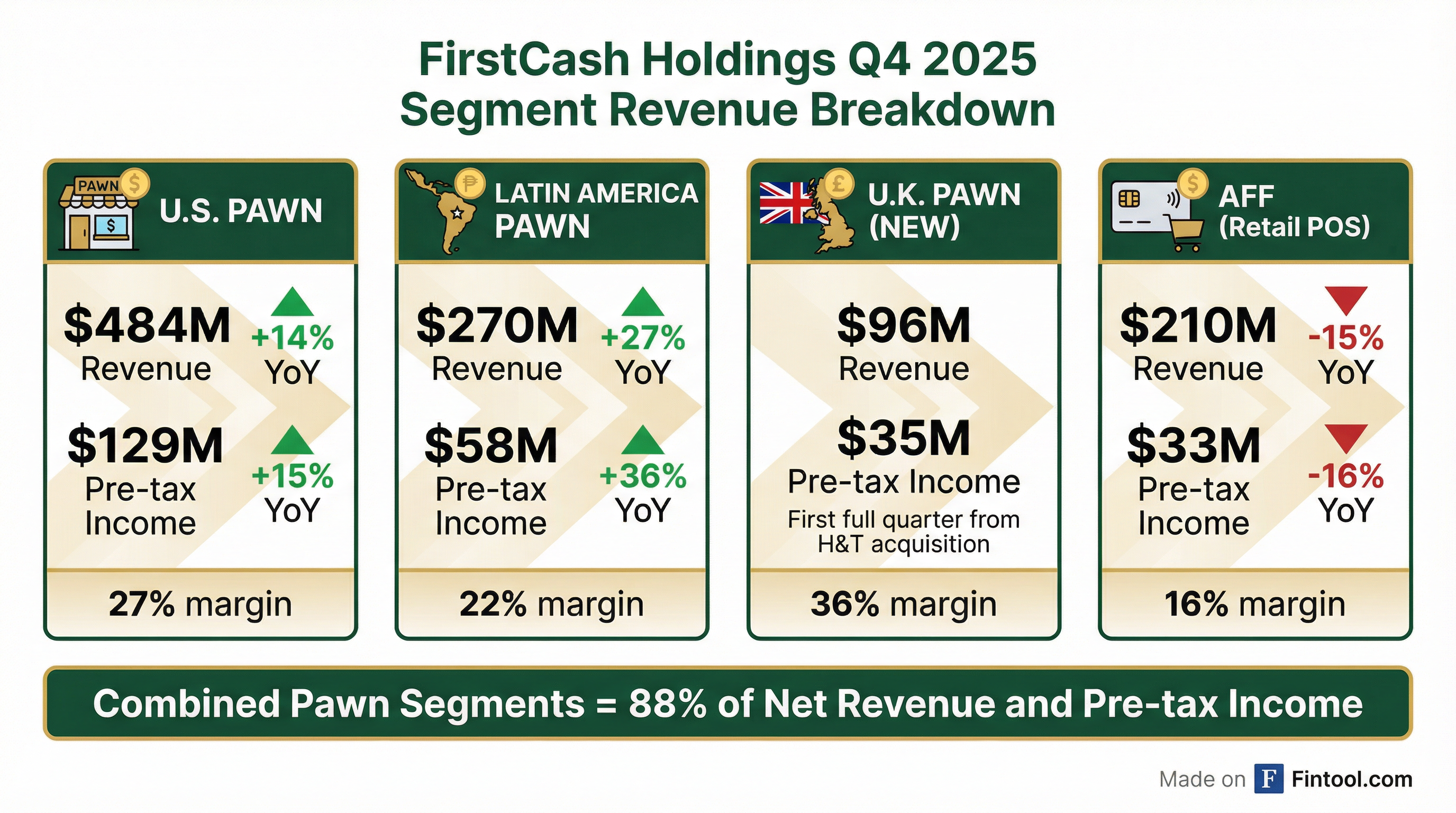

U.K. Segment Now Contributing — Q4 was the first full quarter of H&T results, adding $96M in revenue and $35M in pre-tax income at a 36% margin. This exceeded management's expectations and positions the U.K. for further growth with three new stores already opened in January 2026.

-

Pawn Receivables Accelerated — Combined same-store pawn receivables grew 18% (15% constant currency), the highest in company history. This is the tenth consecutive quarter of double-digit same-store receivables growth in the U.S.

-

AFF Headwinds Moderating — The retail POS payment segment (AFF) saw revenue decline 15% YoY due to American Freight and Conn's bankruptcies in late 2024. However, excluding these retailers, originations increased 8% and management expects a return to overall origination growth in H1 2026.

How Did Each Segment Perform?

Key segment insights:

-

U.S. Pawn: Same-store pawn fees +10%, retail sales +8%. Retail margins held at 43% with aged inventory remaining extremely low at 1.8%.

-

Latin America Pawn: Strongest growth segment with pawn receivables up 38% USD (23% constant currency). Pre-tax income surged 36% on favorable peso exchange and robust demand.

-

U.K. Pawn: First full quarter showing 36% pre-tax margins—the highest of all segments. Pawn receivables grew 25% YoY on local currency basis.

-

AFF: Despite revenue decline, segment remained profitable with $33M pre-tax income. Operating expenses down 32% YoY as management reduced costs.

What Did Management Guide?

2026 outlook is bullish across all pawn segments.

Other guidance:

- Corporate admin expenses: Stable at Q4 2025 run rate

- Interest expense: +5-10% YoY assuming current rates

- Effective tax rate: 25-26%

- Peso sensitivity: Each 1-point change = ~$0.10 EPS impact

Analyst estimates for FY 2026 imply $4.07B revenue (+11% YoY) and $9.92 EPS (+13% YoY).*

How Did the Stock React?

FCFS shares surged +5.9% on earnings day, closing at $177.65—a new 52-week high of $180.87 was hit intraday.

The strong reaction reflects:

- Record revenue milestone exceeding $1B

- Better-than-expected H&T integration

- Confidence in 2026 guidance

Key Management Quotes

CEO Rick Wessel on the quarter:

"FirstCash's achievements in 2025 were phenomenal, with the Company posting another year of record revenue, earnings and operating cash flows. We closed the year especially strong with fourth quarter revenues increasing 20% over last year to surpass $1 billion in a single quarter for the first time in Company history."

On pawn demand drivers:

"Speed, transparency and affordability remain top-of-mind priorities for our customers, whether they are looking for small, safe, non-recourse loans or value-priced retail offerings. Even with the growth in demand, we continue to manage the business prudently by maintaining consistent loan-to-value ratios."

On capital allocation:

"Our strong balance sheet and tremendous cash flows continue to support store expansion. We continue to see and evaluate pawn acquisition opportunities in the U.S., Latin America and now the U.K., while also returning cash to shareholders in the form of ongoing cash dividends and opportunistic stock repurchases."

Capital Allocation and Returns

2025 shareholder returns:

Q1 2026 dividend declared: $0.42/share ($1.68 annualized), payable Feb 27, 2026.

New buyback authorization: $150M program approved October 2025, fully available.

Returns metrics:

- GAAP ROE: 15%

- Adjusted ROE: 18%

- Adjusted ROA: 8%

Balance sheet: Net debt to adjusted EBITDA of 3.0x (2.7x proforma for acquisitions). Total debt of $2.2B with $1.5B in fixed-rate senior notes at 4.625%-6.875% rates with maturities beginning 2028.

Forward Catalysts and Risks

Catalysts:

- Continued H&T integration — Three U.K. stores already opened in January 2026; expect technology synergies as H&T migrates to FirstCash platforms

- Store expansion — Management targeting continued store additions across all three pawn geographies

- Pawn receivables momentum — Record same-store growth suggests strong underlying demand

- AFF recovery — Origination growth expected by H1 2026 as bankruptcy headwinds anniversary

Risks:

- Peso volatility — Each 1-point FX move impacts ~$0.10 EPS; Latin America is 27% of segment revenue

- Interest rate exposure — Variable rate debt on $559M revolver

- AFF merchant concentration — Further retailer bankruptcies could impact payment solutions segment

- Regulatory — Consumer lending regulations across U.S., Mexico, and U.K. jurisdictions